A perspective on Covid-19 statistics can help us better understand the data and the avalanche of data that hits the daily news headlines. According to Bloomberg News, “Global coronavirus infections climbed above 85 million (as of January 4th), and the daily cases in the U.S. soared to a record of nearly 300,000 following the New Year holiday.” So on the surface, this sounds like a lot of people being infected by Covid-19. It is a big number no doubt, but let’s put this and a few more data points in perspective globally and nationally:

A GLOBAL PERSPECTIVE:

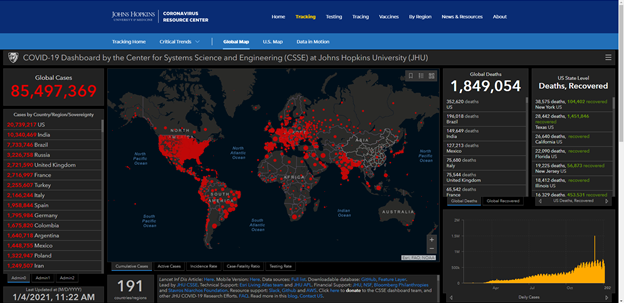

- GLOBAL INFECTIONS – As of today (January 4, 2021) – According to Johns Hopkins University , globally we have reached 85,497,369 people infected by Covid-19. If you divide that number by the total global population of 7,836,800,670 people (according to the World Population Clock), and you arrive at a 1.09% global infection rate (actual # is .0109).

- Global Infection-Death Rate – Once again, according to Johns Hopkins University, the global deaths are currently at 1,849,054. So divide this number by 85,497,369 people infected by Covid-19, and you arrive at a global-infection death rate of 2.16 % (actual # is .0216).

- Global Death Rate – If you divide the number of Covid-19 deaths globally (1,849,054) by the global population (7,836,800,670), this puts the current global-death rate at 0.02% (actual # is .0002).

A NATIONAL PERSPECTIVE:

- NATIONAL INFECTIONS – As of today (January 4, 2021) – According to Johns Hopkins University, the United States has reached 20,739,217 Covid-19 infections. If you divide that number by the total U.S. population of 332,007,863 people (according to the World Population Clock), you arrive at a national-infection rate of 6.25% (actual # is .0625).

- National Infection-Death Rate – Once again, according to Johns Hopkins University, the U.S. deaths are currently at 352,620. So divide this number by 20,739,217 U.S. infections, and you arrive at a U.S. infection-death rate of 1.70% (actual # is .0170).

- National Death Rate – If you divide U.S Covid-19 deaths (352,620) by the U.S. population (332,007,863 people), this puts the current U.S. death rate at 0.1% (actual # is .0011).

STATISTICAL PERSPECTIVE:

- Let’s shift gears now, and look at the flip-side of the deluge of data we’re presented with daily, and referenced above to get an alternate perspective on Covid-19 statistics. Contrary to how the media presents the daily Covid data, there is light at the end of the tunnel as we look at the statistics from the opposite or a macro perspective:

- Globally: (look at the inverse of the above statistics) If 1.09% of the worlds population has been infected by Covid-19, that means that 98.91% of the global population has not been infected (yet). Also, if the global infection-death rate is 2.16%, that means that 97.84% of the global population infected by Covid-19, survive.

- Nationally: (look at the inverse of the above statistics) If 6.25% of the U.S. population has been infected by Covid-19, then that means that 93.75% of the U.S. population has not been infected (yet). In addition, if the U.S. national infection-death rate is 1.70%, then that means that 98.30% of the U.S. population infected by Covid-19, survive.

CONCLUSION:

So now that we’ve provided a perspective on Covid-19 statistics, what does this all mean? What are the implications and lessons learned?

- We understand that Covid-19 appears to be more deadly than the annual flu. Most of us of us have known people who have either been infected or know of someone who has passed away from this virus that normally wouldn’t from the annual flu. However, we also personally know individuals who had completely different Covid illness experiences than others. This is not an ordinary flu virus…it manifests itself differently than the ordinary flu in many ways…sometimes with deadly outcomes. Regardless, all loss of life from this virus had been a tragedy.

- We also have learned that our healthcare workers (and we MUST NOT forget the store workers too…who get paid a lot less!) are true heroes! They and others are putting their lives on the line daily, all to help us! We just need more of these selfless people to meet the demands in situations like this. Which brings me to the next point…

- We’ve also learned that our current health care system is insufficient to adequately handle pandemics. Lack of designated building space, under-supplied medical devices and equipment, and under-staffed medical personnel has resulted in overcrowded ER and ICU facilities. (We personally have family and friends who are physicians/ nurses/ health service providers etc…and we’ve heard their direct testimonies.) Our healthcare system is over-burdened, over-run and short-staffed, which we believe is also a national tragedy. (We’ll address these particular issues more, along with possible solutions in another post later this month).

- As we apply discernment of Covid-19 statistics (from the above sections), it begs the questions:

- Do the above statistics merit the shut-downs and closures of our local and global economies. Does it merit the loss of millions of small businesses and the rising unemployment (while the large corporations keep getting fatter and bigger)?

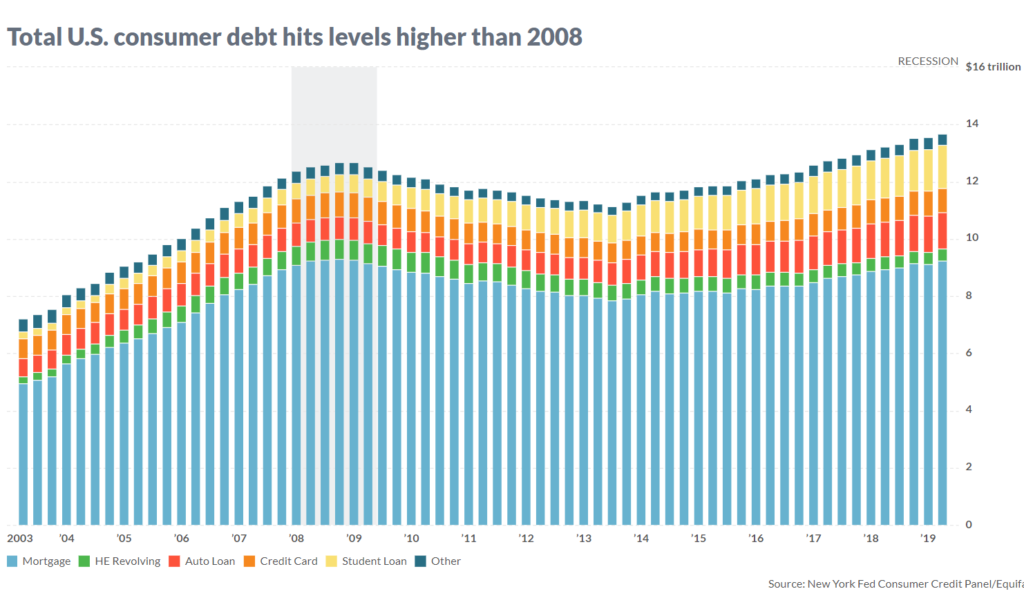

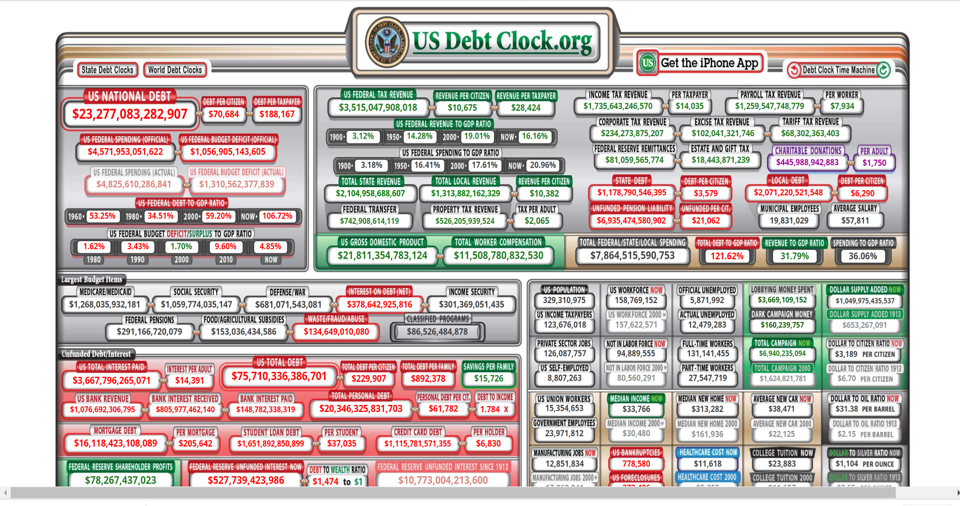

- What will be the real financial implications, in terms of loss of economic productivity? PLUS, what will be the the future impact on our economies as a result of the voracious appetite of digital money being poured into the world economies? World debt and our national debt have never been higher, and this will eventually have an impact. The question is…to what extent and for how long?

- Given the “warp-speed” vaccine roll-outs (which normally take years to complete), how effective will the vaccines be in 3, 6 or 12 months from now?

- What are/will be the medical side effects?

- Have we sacrificed good science for the sake of a rushed solution that may prove ineffective? If so, at what cost?

- Who is gain the most? Hopefully humanity at large will gain the most. (We hope the people are the beneficiaries, particularly the elderly and those with co-morbidities).

- Who else is to gain?

- When it comes to vaccines, we tend to be a little jaded by the industry that produces these. Here are three links to interviews that may better articulate our skeptical position on today’s vaccines:

- https://www.youtube.com/watch?v=QLi6ZrFp6vQ

- https://www.youtube.com/watch?v=IfnJi7yLKgE

- https://www.youtube.com/watch?v=92qdsxo5dyw (fast forward to the 4:27 mark to skip the marketing introduction)

- So many questions will be answered in time…but at what cost?

We hope this post on A Perspective on Covid-19 Statistics has brought some alternate ways of evaluating the data presented to us, and to help raise more questions to discuss, evaluate and consider. We look forward to following up on a few of these points previously made above in future posts. Until then, as we always say, “Do your own research, then make a better informed decision.”

GMS BUSINESS CONSULTING, INC. – Provides lawyers/law firms, for-profit & non-profit organizations, and other business professionals with Accounting Services, Business Development Services (M.A.P.), Business Optimization Services, and Digital Marketing Services. We help business professionals strategically manage and tactically grow their businesses more effectively and efficiently. We do NOT provide investment advice. Contact Us if you are interested in learning more about our services, and in particular about M.A.P. (our 3-phase business development & management solution), designed to help you strategically manage and tactically grow your business. We would welcome the opportunity to speak with you.

info@gmsbusinessconsulting.com

707-218-3135

An

An