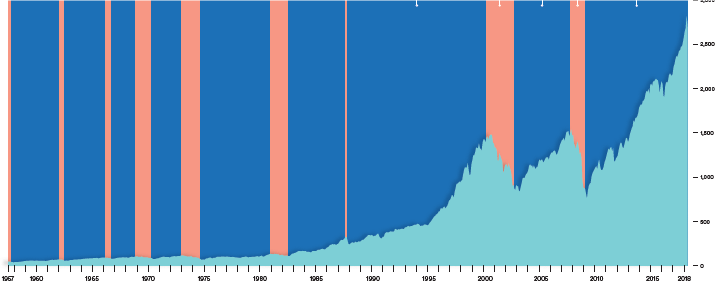

Good morning everyone…this morning’s post is on how to prepare your practice for the coming economic crisis. As the saying goes, a picture is worth a thousand words… The chart above is taken from the Charles Schwab Summer issue of “On Investing” (pgs. 20-21). While we don’t give clients personal investment advice, we do guide clients through their business planning, strategizing and implementation through various economic cycles. We have been warning clients for quite some time that markets are over-valued, and when they are over-valued, there is inherent risk…both to their personal net worth and to their business. We guide clients to better prepare and position their businesses for economic upturns and downturns, and in our opinion, there is a looming monumental shift in our economy and in the financial markets on the horizon…

As the above chart shows, the stock market has gone to stratosphere levels during a time when interest rates (until VERY recently) have been at historic lows, yet the amount of U.S. and global debt has more than tripled since the 2008-2009 economic crisis! Does this sound like a healthy economy? Or does this better describe a stock market and an economy that has been inflated by excessive debt?

The tides are beginning to change…interest rates have been slowly increasing, and perhaps may even invert (signifying a coming recession…or perhaps worse), and costly fuel prices have been on the rise. In our opinion, the stock/bond/real estate markets are all at frothy states of dangerous optimism. Our advice to clients, family members and friends willing to listen is to:

- Shore-up your business and personal cash reserves.

- Re-position your business/practice Strategy to take advantage of the soon coming economic downturn.

- Re-position your business/practice Operations both offensively and a defensively to position your practice to survive and thrive in the soon coming economic storm. (by implementing our M.A.P. solution)

- Re-position your business/practice Business Development initiatives both offensively and a defensively to position your practice to survive and thrive in the soon coming economic storm. (by implementing our M.A.P. solution)

- Re-assess your business Value-Proposition to help your clients navigate a successful course through the coming economic head-winds.

- Define your desired target market industries within your sphere of professional expertise and influence that you can assist and add value to, then deliberately and consistently communicate your perspectives and value-proposition to them.

- Implement a M.A.P. (your Master Action Plan) to guide you step-by-step through all the fore-mentioned strategies, processes and procedures to successfully meet your clients needs, and ultimately meet your business goals and objectives.

To better understand how our M.A.P. can help successfully guide you and your clients through the coming economic crisis, Contact Us. We would welcome the opportunity to speak with you.

GMS Business Consulting – provides lawyers and business professionals with Accounting Services, Business Development Services, Business Optimization Services and Digital Marketing Services to help business professionals successfully organize, grow and operate their businesses more effectively and efficiently. We do NOT provide investment advice. Contact Us if you are interested in learning more about our services, and in particular about M.A.P.(our 3-phase business development solution), designed to help you strategically focus and tactically grow your business. We would welcome the opportunity to speak with you.

info@gmsbusinessconsulting.com

707-218-3135

John 14:15