BACKGROUND:

Blockchain or Hashgraph technology. We believe our readers want to better understand what technology will drive global ecommerce in the future from banking & financial to consumer product transactions.

To better understand this issue, it’s important to understand the two primary technologies available in the marketplace today, and to assess the differences in terms of capability, viability, practicality of application, speed of processing, and transactional costs. Based on our understanding, the two main competing technologies existing today for future consideration is either going to be Blockchain or Hashgraph technology. We thought now would be a good time to re-post one of our previous posts from February 2018 that addresses the differences between Blockchain vs. Hashgraph technologies. Understanding the differences between these two technologies will help our readers to better understand their viabilities in the future.

Once you finish listening to and reading the linked interviews and charts, you too will be better positioned to determine which technology will prevail globally, and which technology will more likely to be used in the future for cryptocurrencies as well.

CRYPTOCURRENCIES & BITCOIN:

We also believe this re-post of evaluating the future viability of Blockchain or Hashgraph technology is timely as well. We also want to draw your attention to the challenges and opportunities with both technologies (Blockchain or Hashgraph), and how they affect cryptocurrencies like Bitcoin. In light of the recent attention and steep run-up of Bitcoin ($18,000+), we do want to state that we certainly believe cryptocurrencies ARE the future monetary mechanism of conducting financial transactions and settlement on a global basis. The question is, will future cryptocurrencies be based on Blockchain or Hashgraph technology?

Based on the evidence we have seen so far, Bitcoin and the Blockchain technology it is based on, can NOT be viewed as a sustainable global digital currency. Please listen to the following links below, as they address the opportunities and challenges of these technologies; from the simplest in concept, to more complex discussions:

KEY VIDEOS & INTERVIEWS:

- https://youtu.be/gah5IgRb7qw

- https://youtu.be/SF362xxcfdk

- https://youtu.be/CaZSxvO4T3M

- https://youtu.be/evWBgNdWNDk

- https://youtu.be/pOc23lJw7ls

- https://youtu.be/1NBfH7dMK4Y

- https://www.youtube.com/watch?v=RLkhwFQSPyY&list=TLPQMjEwMjIwMjF4Ag6m8srIkQ&index=3

- https://www.youtube.com/watch?v=BfmDDg8KuTI

- https://www.youtube.com/watch?v=hzxGIAvzNgM

- https://www.bloomberg.com/opinion/articles/2021-03-24/bitcoin-miners-are-on-a-path-to-self-destruction

COMPARATIVE DATA:

I encourage you to CAREFULLY listen to each interview link (above) from our original POST, and also look at the following two comparative charts on processing capabilities and costs:

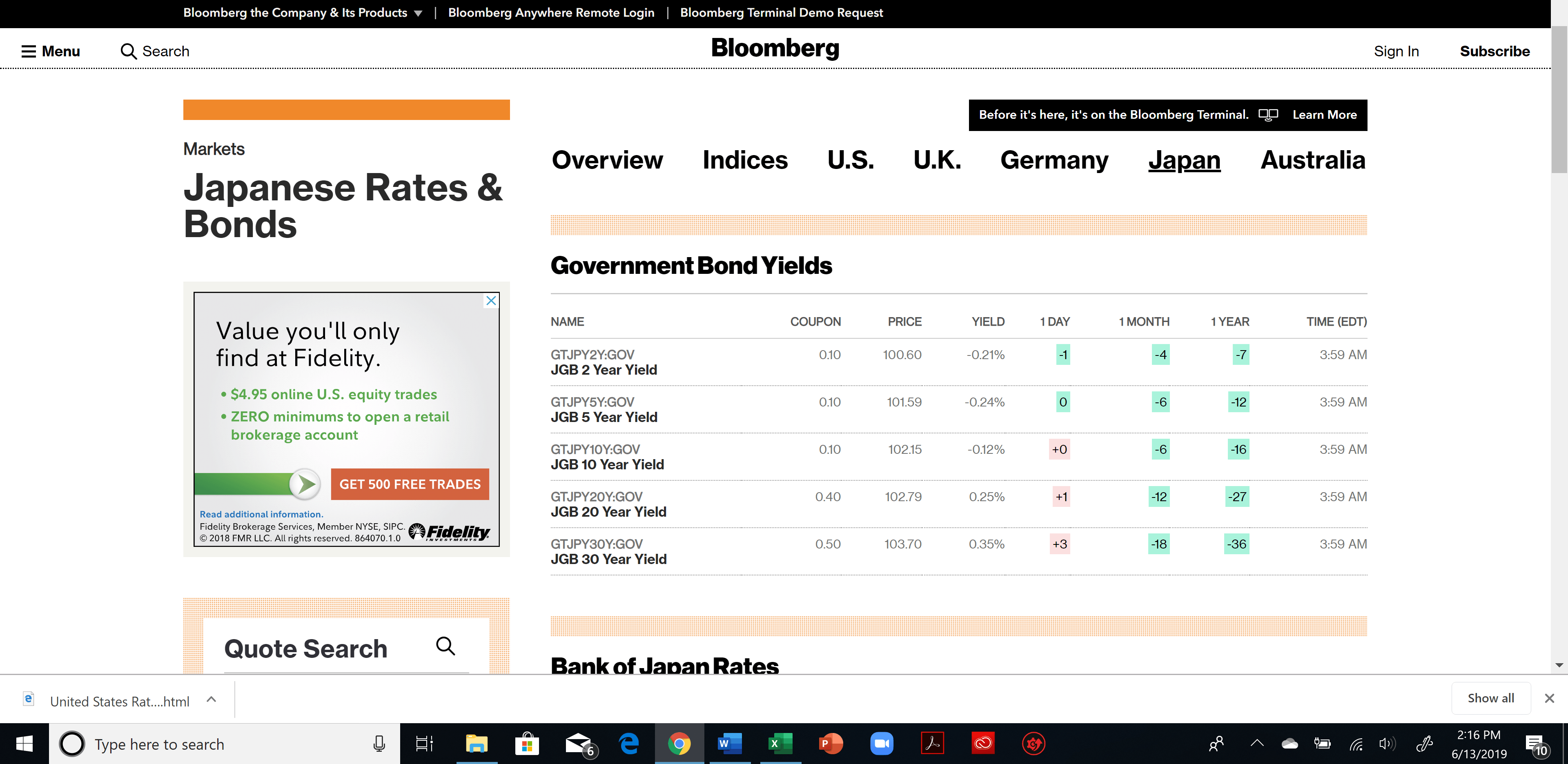

COMPARATIVE CHART #1 – statistics backing these claims.

COMPARATIVE CHART #2 – Here’s another comparison of Bitcoin vs. Hashgraph cryptocurrency performance.

CONCLUSION:

Based on these interviews, and the data we have reviewed and shared, we believe the evidence is quite clear. Hashgraph technology will lead the future in global transactional infrastructure. Why isn’t this being discussed in the mainstream media? We’re not sure…

The reason for our re-post and further discussion of Blockchain or Hashgraph technology has been influenced by recent news commentaries, public discussions and opinions, and lastly by the comments of close friends and relatives. Of particular interest to us is the fact these same relatives and friends who have little or no experience in business, finance, financial markets, and cryptocurrency technology are now experts in these areas. The fact that these same family and friends most interested in cryptocurrencies are the ones who don’t own any other investment assets (other than Bitcoin). This is a red herring to us, as they are now suddenly the experts, touting the merits and future potential of Bitcoin and Blockchain technology. We’re not saying you have to be a financial expert to properly identify and evaluate investment opportunities. Quite the contrary! What’s more important to us, is to be open-minded to conduct further research, ask more questions, evaluate alternative data and information, and then compare what you’ve obtained with the information that is currently popular on mainstream news and in discussion groups.

Our concern is, like with speculative stock trading on Wall Street Bitcoin and many cryptocurrencies may be experiencing a “pump-and-dump” or as it is known in the crypto world as “the rug pull”. This process may be applied with speculators or traders or speculators of many cryptos, including Bitcoin. These speculators use clever marketing strategies (including word of mouth and social media postings )to lure new customers to their products. Surprisingly, even more reputable companies like PayPal and Visa are now offering cryptocurrencies (like Bitcoin), as means of transaction processing and offer reward incentives to do so. My question is, do the CEO’s and CTO’s not understand the technology this is based on given its unsustainability, limitations, and high transactional costs? If not, why not? We thought this ARTICLE on cryptocurrencies posted today on Bloomberg (7-08-21) would be of interest too. Seems like others may finally be waking up to the fact that there really does need to be some form of regulatory oversight on cryptos, as they are intended to be a means of conducting reliable financial transactions, not for pure speculation. At least that’s our position.

All that said, getting back to the issue of Blockchain vs Hashgraph technology, our question is: If a better technology platform solution exists (like Hashgraph), and a cryptocurrency utilizes this superior technology, then why would you put your money into a cryptocurrency (like Bitcoin and others) that utilize an inferior technology platform like Blockchain? It just makes no logical sense to us other than perhaps this is purely a speculative trade or crypto bubble (speaking of Bitcoin and others alike). Many people may make a lot of money trading these cryptocurrencies, but unfortunately many people will also get burned in the long-run as well. Yes, money can be made in trading crypto’s, perhaps lots of money can be made by speculative trading by those experienced in day trading, but what about the average Joe? That’s why we’re posting this subject again…to offer another cautionary perspective to the public and to our readers. Just keep in mind… isn’t a key characteristic of a “credible/reliable” currency based on history of stability and not extreme high volatility?

I hope we’re wrong on this one… True, Bitcoin can go higher…perhaps much higher, but based on what? Speculation or sustainability? Only time will tell. Until then, we hope you find this information helpful in your evaluation of future global technology and cryptocurrencies, whether it be based on Blockchain or Hashgraph. Remember, do your own homework, then make a better informed decision.

GMS BUSINESS CONSULTING, INC. – Provides lawyers/law firms, for-profit & non-profit organizations, and business professionals with Accounting Services, Business Development Services (M.A.P.), Business Optimization Services, and Digital Marketing Services. We help business professionals strategically manage and tactically grow their businesses more effectively and efficiently. We do NOT provide investment advice. Contact Us if you are interested in learning more about our services, and in particular about M.A.P. (our 3-phase business development & management solution), designed to help you strategically manage and tactically grow your business. We would welcome the opportunity to speak with you.

info@gmsbusinessconsulting.com

707-218-3135