Our financial opioid addiction is debt! Record household debt is at an all-time high. Does it matter? Our national debt is at a record high. Does it matter? What does this mean to you and me, and for our country? Read further then you decide for yourself…

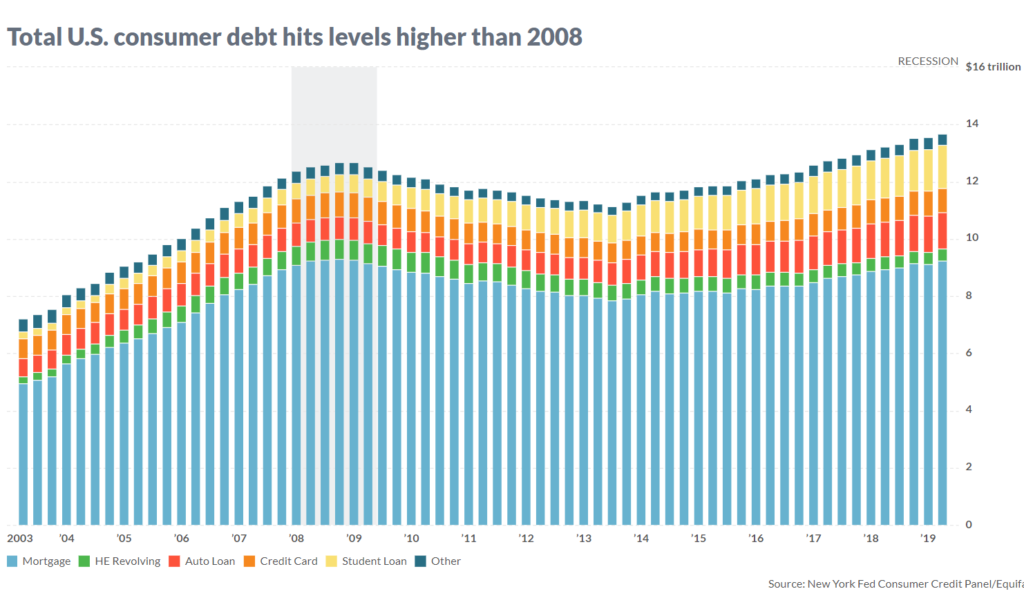

According to these articles on MarketWatch and Bloomberg, household debt exceeded $14 TRILLION dollars by the end of 2019. According to these articles, this past quarter was the 22nd STRAIGHT quarterly increase in consumer debt! Mainstream business news pundits claim the economy is strong, and that consumer purchasing is strong etc. It makes me ask, what business school did they attend? What business principles are they applying to come to these conclusions? These pundits appear to be bright, articulate, well-educated and sincere people…and I’m sure they are! But what do they see that I don’t see or understand that I don’t understand? Let’s look at the strength of the consumer and our overall economy from a macro perspective so that we can better understand the underlying principles of this s0-called economic “strength” that mainstream media pundits claim.

FIRST:

Let’s assume that we can first agree on one basic principle that debt is debt. Debt means that you owe money for an item you purchased… you do not own that particular item/asset until it is paid off. If you can’t afford to buy something outright, then debt it taken on because in most cases one doesn’t have the financial means to make an outright purchase of an item or asset, rather you have reserved the right to take possession of that item or asset until that item has been fully paid for…then you have actual ownership. You may have “reserved” title of ownership such as in your home or the car you drive…but you don’t actually own it until it is paid off. (Try missing 2-3 payments then you’ll quickly understand who the owner is and who the debtor of that asset really is.) Have we forgotten this basic principle? In some cases, debt may be assumed by individuals to charge an item in order to gain the mileage points or whatever incentive is being offered. (I too have done this myself in order to obtain additional discounts on the items I was purchasing…but then I paid off the balance completely when the first bill came due. I no longer carried that debt, and in those situations, short-term debt can make good financial sense.) But that’s not what we’re talking about here... The $14 TRILLION in consumer debt has obviously not been paid off, rather it has steadily increased each quarter for the past 22 quarters. What does that tell you? As consumers and as a nation, we are in the midst of a financial opioid addiction.

This record amount of consumer debt tells us, that rather than consumers paying off debt, the consumer’s debt continues to grow. Why? Well, for several reasons; credit is continuously being extended, wages aren’t keeping up with inflation, and we are living beyond our means. Thus, financial opioid addiction! This continuous growth in consumer debt keeps fueling this “ponzi scheme” of the American economic mind-set. This will eventually lead to the ultimate destruction of the consumer’s future financial well-being. Pundits say the consumer is confident and is therefore spending more. Should they be? If they are so confident, then why take on more debt…more servitude to debtors rather than paying down the debt already owed, and loosen the financial bonds that will further strangle them when the next financial crisis hits?

SECOND:

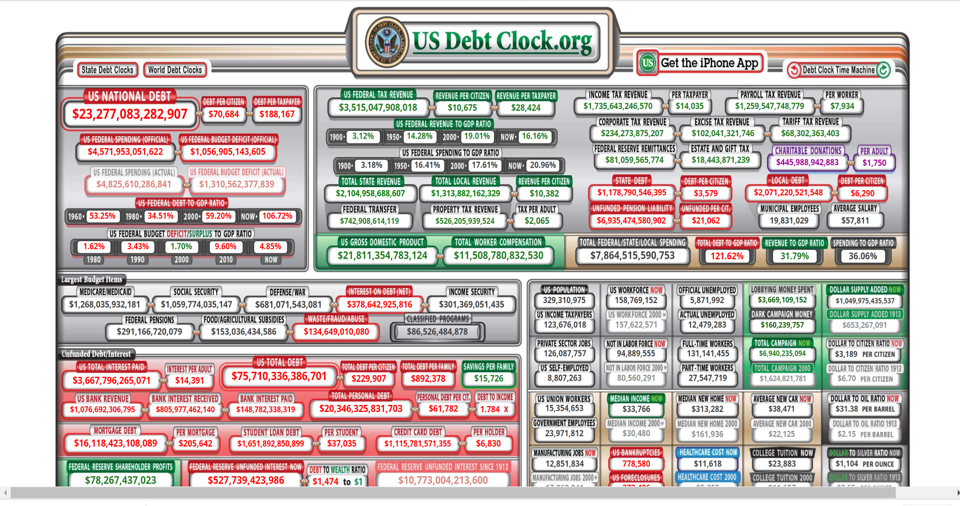

Consumer debt is simply a mirror image of the mind-set of the U.S. national debt, which is currently at $23.2 TRILLION (according to the U.S. Treasury). The highest in world history. Why is this? Because currently, the U.S. still maintains the “World Reserve Currency”…meaning we can print all the money all we want or need (digitally and physically), while the rest of the world cannot. We’re able to finance (issue debt/ create money out of thin air/ for anything we want militarily, financially, infrastructurally, you name it (at least we can for the time being). The U.S. Government and consumers alike are suffering from financial opioid addiction…period. As American consumers, we have become accustomed to buy whatever we want, whenever we want without forethought of what it means to our financial future. So the pundits state that our the economy the most powerful/prosperous in the world. Is it really? Or is it because we carry the highest amount of debt of any other nation or people in the history of the world? It sure sounds like borrowed materialism and prosperity without paying for it! We just keep kicking the financial opioid debt down the financial highway of destruction. Have you ever considered if all debt was called in immediately or if the taps to this opioid debt were suddenly cut-off? What would happen to this nation…to us individually? We would be bankrupt (we already are). The rest of the world just playing along… Take a look below at the U.S. Debt Clock as of 2-11-20, the U.S. national debt. Is this the proof of prosperity or indebted fake prosperity?

Our economy and our consumers alike have “seemingly” flourished because we have access to a never-ending source of debt. One problem: Someday this situation will come crashing to an end, and unfortunately we as a country and individually as consumers will have to live through those consequences. But until then, keep the economy going! Spend, spend, spend! Come on consumers, do the American thing… keep on spending and taking on more debt… it’s what comprises two-thirds of our economy! Is that really economic strength or is it economic weakness? Is that what we really represent to the world? As a Christian nation founded on Christian values and principles, is that what the Bible teaches us?

Have you ever thought of what would happen if/when the “World Reserve Currency” status is taken away from the U.S.? OR…when the rest of the world no longer recognizes the U.S. dollar as the world reserve currency? Have you ever thought of that? What it would be like for you/ your children/ or your grandchildren when that day comes, and we can no longer digitally or physically print as much money as we “want or need” to service our debt? Considered what it will mean financially to our country, to you and your families? I would encourage you to give some critical thought to that for moment…it’s pretty sobering.

THIRD:

What will happen to the U.S. consumer when the next economic downturn happens… when credit is once again tightened/ or reduced/or restricted and we can no longer charge or incur debt to pay for items we want or NEED? My point is… for many of us, our personal and national financial condition is built on DEBT. When this financial house of cards begins to fall, when this financial ponzi-scheme begins to implode, those with debt will suffer the most. Consider this article from Bloomberg this morning regarding Fed Chairman Powell’s comments on the next economic crisis… Will the Federal Reserve have enough ammo to fight the next recession? My question to each of us is, will we individually have enough financial ammo in our personal arsenal (savings and owned assets) for us to survive the next recession?

CONCLUSION:

It may be worth considering, that with the stock market at all-time highs, the bond market near all-time highs and the real estate market at all-time highs, wouldn’t it be prudent as a consumer to tighten our spending and reduce our debt rather than increasing our debt? Perhaps for those with some market investments to consider reducing their market investment exposure, and take some of the profits and use them to pay-down debt? Remember the wise old saying, “Buy low…Sell high” that generations before us better understood?

For those who don’t have investments to liquidate and apply the gains to pay down debt, perhaps they can begin to implement a debt pay-off plan vs. purchasing the newest smartphone (avoiding brand names) or other like-kind spending choices? As mentioned earlier, we have become consumers and a nation of the financial opioid called debt. We’re addicted and we don’t seem to care too much about that right now or at least we won’t until the opioid is someday taken away. Wouldn’t it be wonderful for us to change the mindsets of financial pundits from expressing that it’s good that consumers are “spending” (i.e. taking on more debt), to consumers are now saving and paying down debt, therefore reducing their servitude to debtors? Will our economy grow more slowly, yes. But as a nation and individually we will be financially stronger, enabling us to better weather the next financial storm that lies ahead, and begin to shed our financial opioid addiction to debt.

GMS BUSINESS CONSULTING, INC. – provides lawyers/law firms, for-profit & non-profit organizations, and business professionals with Accounting Services, Business Development Services, Business Optimization Services, and Digital Marketing Services. We help business professionals strategically manage and tactically grow their businesses more effectively and efficiently. We do NOT provide investment advice. Contact Us if you are interested in learning more about our services, and in particular about M.A.P. (our 3-phase business development & management solution), designed to help you strategically manage and tactically grow your business. We would welcome the opportunity to speak with you.

info@gmsbusinessconsulting.com

707-218-3135