Interest rates tell the story… Good morning readers! Do you want to know where the economy is heading, where the stock market is going, the overall health of the economy? Just follow the interest rates and their upward or downward direction.

How does this affect you as an individual and as a business owner? It affects your personal income and business income, as upward and downward movements in interest rates create both challenges and opportunities. This is pretty basic for most of you. However, we’re going to highlight some interest rate basics below, to help you understand a few charts we’re about to display in a few minutes. But first, here are the basics:

Interest Rate Impact:

- Rising Interest Rates – As interest rates begin rising, it’s usually due to one or more reasons:

- The economy is heating up, and inflation becomes a concern, so the Federal Reserve increases interest rates to help keep inflation under control. Or…

- The local currency is weakening against other leading currencies. So, interest rate increases may be used by the Federal Reserve to prop-up the local currency (too deep for this posting). Or…

- Wall Street/or world financial markets indicate that they see an overheating economy, thus urging central banks to raise interest rates.

- Lowering Interest Rates – As interest rates begin declining, it’s usually due to one or more reasons:

- The economy is slowing down and verging on recession or is in the midst of a recession, and inflation concerns begin to lessen, so the Federal Reserve may lower interest rates to help the economy avoid further decline and begin stimulating the economy towards positive growth. Or…

- The local currency is gaining too much strength against other leading currencies, thus impacting its ability to export goods and services. So, interest rate decreases may be used by the Federal Reserve to weaken the local currency to help encourage its exports to foreign countries (too complex for further discussion in this posting). Or…

- Wall Street/or world financial markets indicate that they see a declining economy, thus urging central banks to lower interest rates.

From a Personal and Business Perspective:

- PERSONAL PERSPECTIVE:

- Existing Loans – As interest rates increase or decrease, any adjustable loan payments you have may adjust either upward or downward in accordance with the direction of interest rates. Thus making your loan payments either higher or lower (pretty obvious).

- New Loan Qualification & Payment – Your personal income may be affected positively or negatively by any future loans you may be considering or may qualify for (such as home, auto, or personal loans), making your monthly loan payment either more or less expensive in accordance with the direction of interest rates (pretty obvious too, right?).

- BUSINESS PERSPECTIVE:

- As interest rates increase or decrease, business loans etc. become more or less expensive, thus affecting the business cash-flow positively or negatively (obvious once again).

- As interest rates increase, the other costs of business usually increase as well. This reflects an expanding economy where the costs of doing business increase due to an increasing demand for materials and services out-pacing existing supplies.

- As interest rates decrease, the costs of conducting business tends to decrease as well. This reflects a slowing or contracting economy that may be either going into a recession or may already be in a recession. This is simply due to the supply of materials and services outpacing demand.

Once Again… Interest Rates Tell The Story:

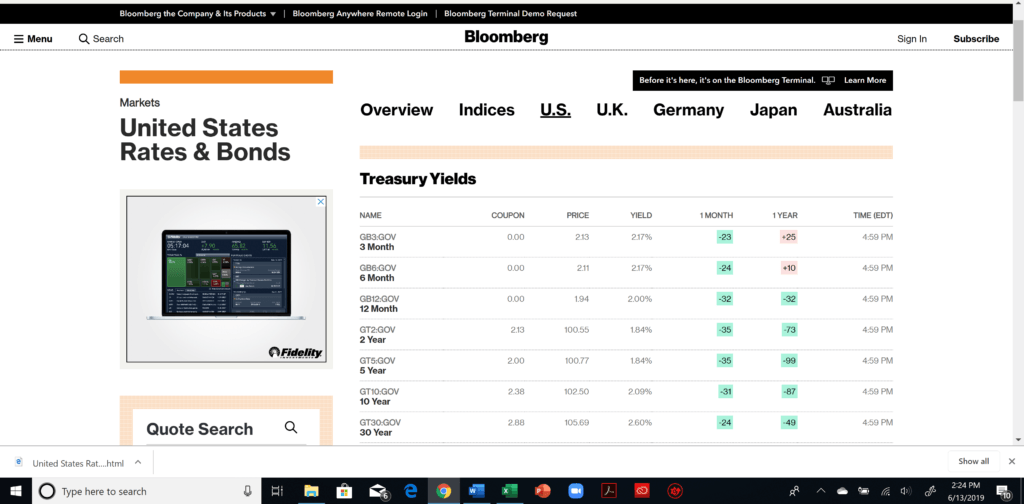

Let’s now look at the charts below, beginning with interest rates here in the U.S. What story does this chart tell YOU, and how will they impact you personally and professionally?

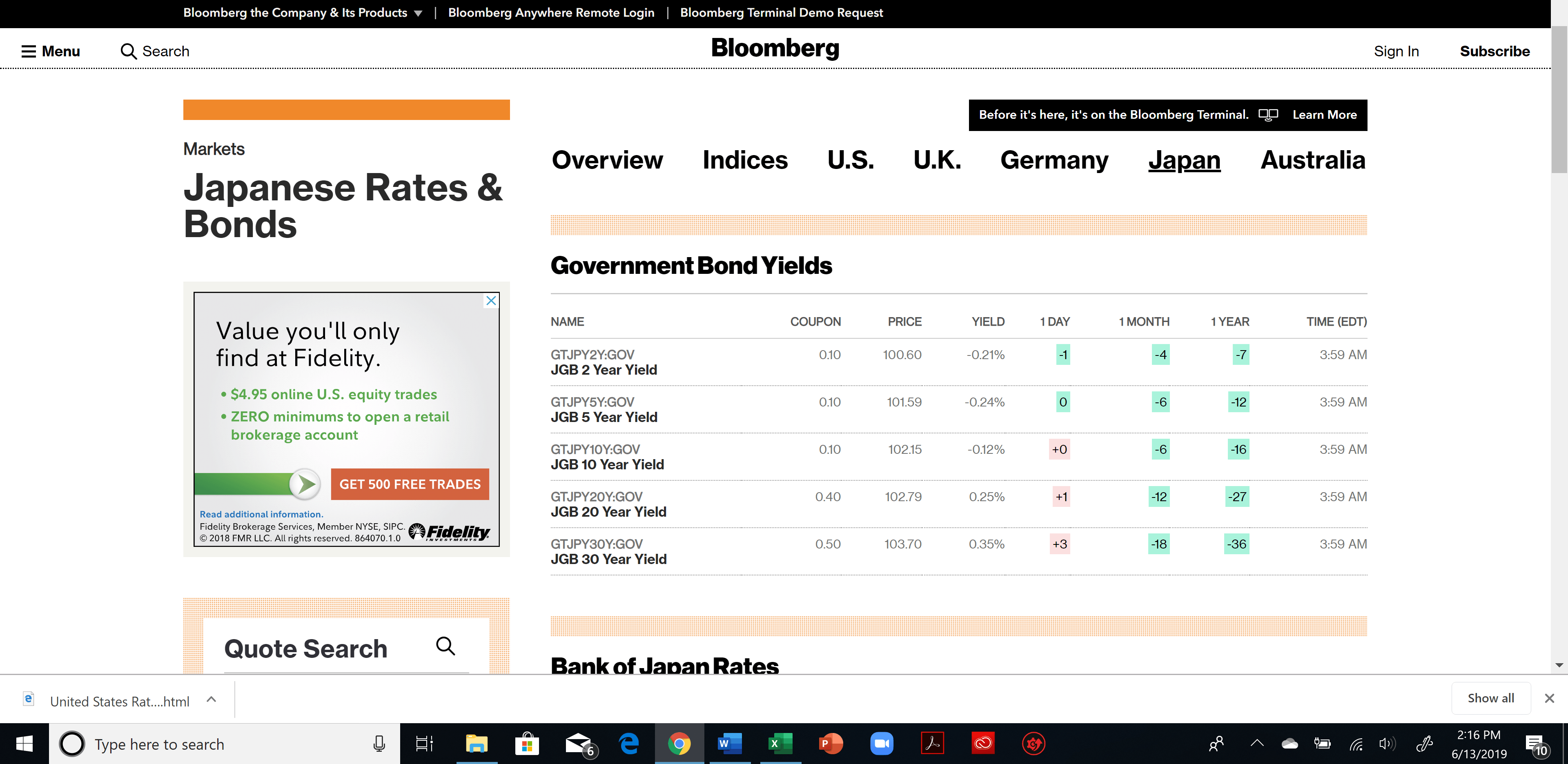

Let’s now take a look at Interest Rates in the UK…

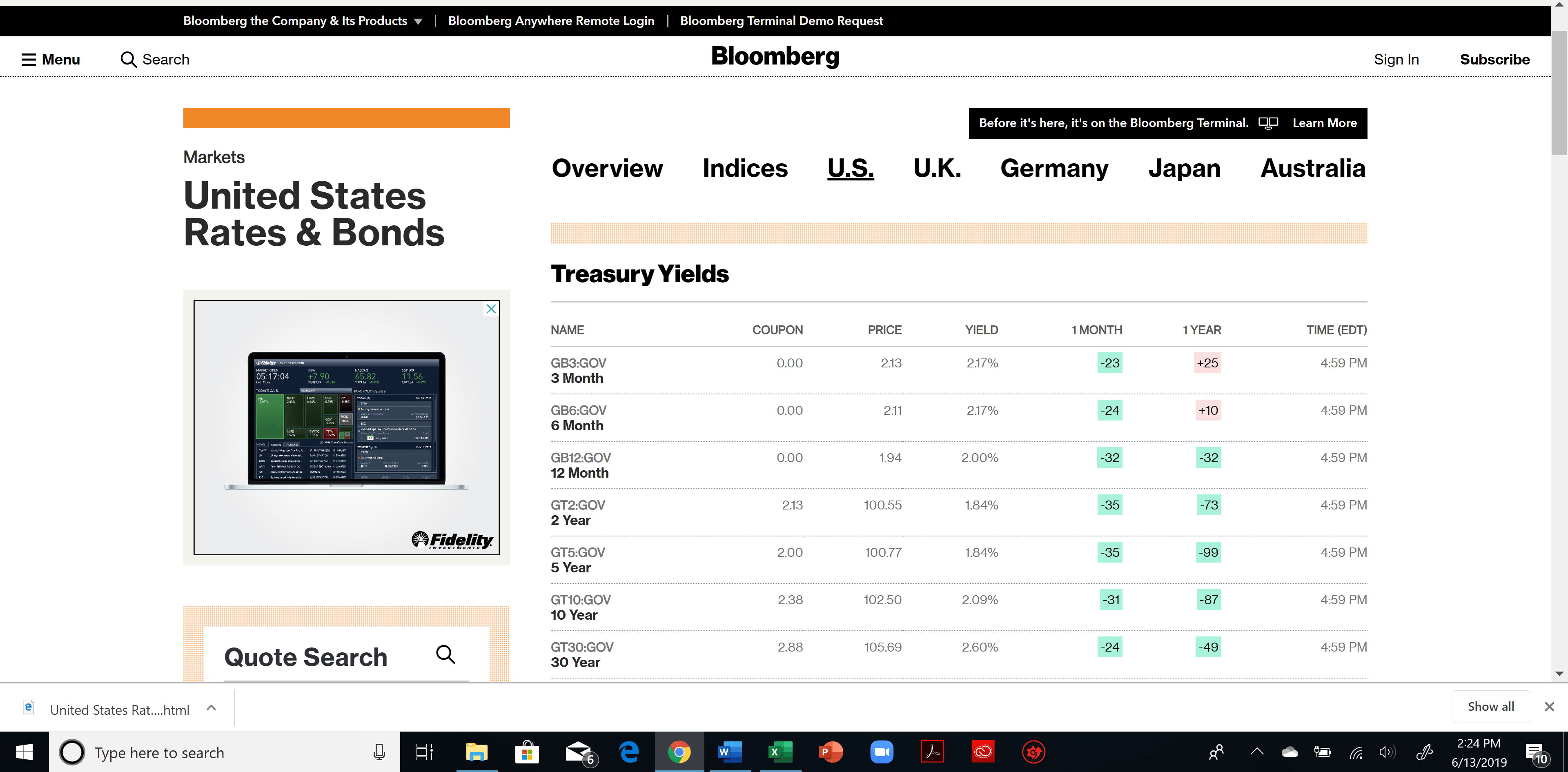

Lets now look at interest rates in Germany (Europe’s leading economy)…

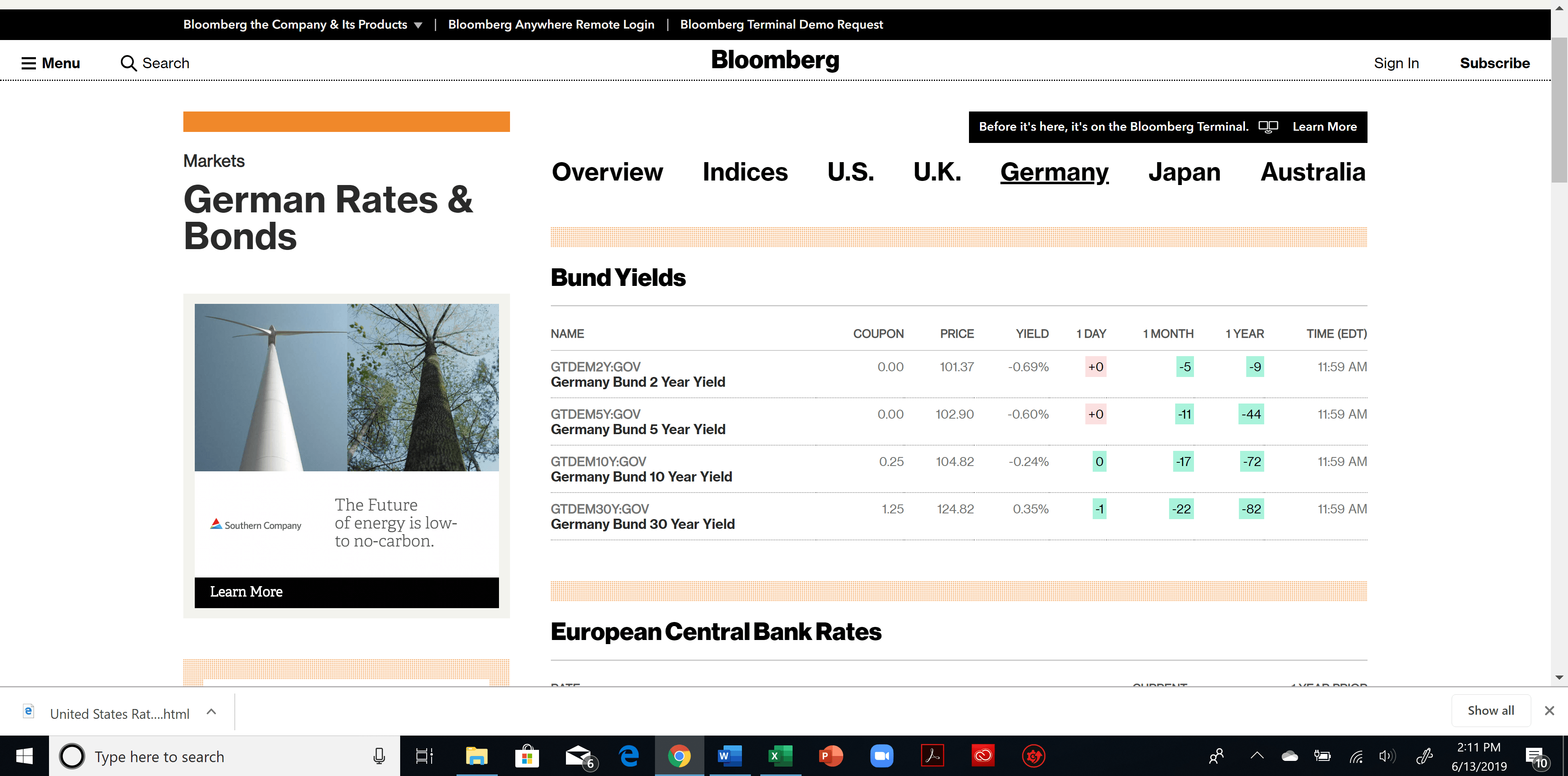

Finally, lets take a look at interest rates in Japan…

So, have you noticed a common theme among the “leading” economies of the world when it comes to interest rates? Interest rates are near all-time lows! What does this signify to you? Eleven years after the 2008 – 2009 financial crisis, interest rates here in the US are still near historic lows, and the next two leading economies (behind the US), are even lower. In fact, they are at negative interest rates. It is sometimes explained as an incentive for banks to loan money because depositors will hoard their cash…is that so?

We believe negative interest rates may also reflect something vastly different. Perhaps that the underlying condition of the economy is fragile…very fragile. The economy would have to be very fragile in order to bring interest rates near all-time lows, correct? Then…perhaps to encourage banks to loan money they could take rates lower in order to incentivize lending. But the lending couldn’t be the key reason why interest rates would drop so low. It has to be that the sate of the economy is in such a fragile state that rates needed to be lowered in effort to stimulate a failing economy. We believe that’s the real reason why central banks are lowering interest rates drop so low. They may be out of tricks to keep the world economy running on runaway debt that can never be paid back.

Look at what has happened to Japan over the past two decades? Is this signaling what could happen here in the US? In either case, our point is, that current interest rates on a global levels do not reflect healthy economies nor a healthy financial system. If that’s the case, then how do you prepare yourself personally and professionally? That will be the subject of our next post in several weeks. Until then, do your own research and give this issue some critical thought. It may affect your near-term and long-term planning both personally and professionally. Remember, Interest rates tell the story…what story are they telling you?

GMS BUSINESS CONSULTING, INC. – provides lawyers and business professionals with Accounting Services, Business Development Services, Business Optimization Services and Digital Marketing Services. We do NOT provide investment advice! If you are interested in learning more about our consulting services, especially our M.A.P. solution (a Master Action Plan), designed to help business professionals to strategically manage and tactically grow their business, then Contact Us… We would welcome the opportunity to speak with you.

info@gmsbusinessconsulting.com

707-218-3135

John 14:15