Hello everyone, today’s post centers on a Practice Performance Indicators (PPI’s) that we believe, reveals significant portions of the overall financial health for both large and small law firms. At GMS Business Consulting, Inc. we constantly monitor and evaluate specific PPI’s on an a regular basis to measure our client’s adherence to their TAP (Tactical Action Plan) and their profitability objectives. We recently reviewed a Legal Trends Report produced by Clio (the legal industry software platform focused on Matter Management and Time & Billings).

While this report predominantly focuses a majority of its attention on AI’s adoption and utilization within law firm operations (which we’ll address in our next post), one section in particular caught our attention. This section is located on Page 63 of the report, titled “Key Performance Indicators.” These same indicators are among the same ones we track within our TAP solution for our clients. See the chart below, and click the image to go to the Clio Report:

Three Performance Indicators

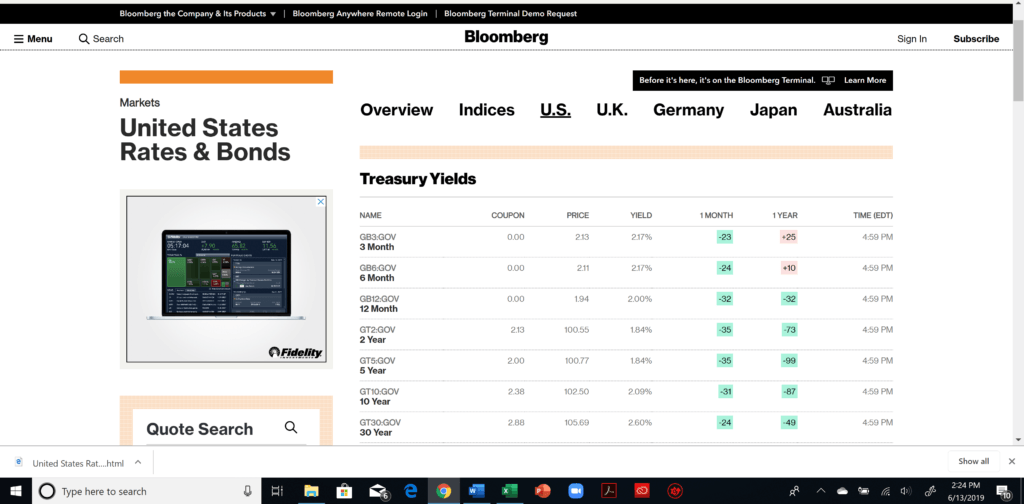

These three specific indicators are identified as the “Utilization Rate“, “Realization Rate“, and the “Collection Rate“, and are expressed as a percentage of an 8-hour workday. These indicators breakdown the hourly revenue efficiencies or inefficiencies for each individual lawyer and for the law firm as a whole, to measure their overall earnings performance, effectiveness, and financial health. Project these numbers over a weekly, monthly, and annual basis without addressing the issues behind the numbers can be destructive to your practice line and to the firm. The results that Clio published, are very consistent with our experience over the years working with law firms. The question for the lawyers reading this post is, “Do these numbers reflective my situation?“

How We Can Help

The good news is.. that each of these three indicators can be corrected. If your chargeability Utilization, Realization or Collection rates are below 90%, then we can help you with our TAP solution. This situation is VERY common in the legal industry. However, it can be fixed if properly addressed, monitored, and evaluated with the appropriate tools and coaching. We can provide that support…

If your chargeability Utilization, Realization or Collection rates are at the 90% or above threshold, we commend you! That said, even if all three indicator rates are above 90%, we are still very confident there are other areas within your law practice that can be optimized to improve your effectiveness, efficiency, and profitability through our TAP solution. Click HERE to learn more about our TAP solution…

We hope you find this post to be thought provoking, insightful, and helpful to you and your law practice. Contact Us if we can be of service or if you simply have any questions. We wish you a very happy, healthy, and prosperous New Year.

About Us

GMS BUSINESS CONSULTING, INC. – Provides lawyers/law firms, for-profit & non-profit organizations, and business professionals with Value-Accounting Services, Business Management & Development Services (utilizing our TAP Solution), Business Optimization Services, and Digital Marketing Services. We help business professionals strategically manage and tactically grow their businesses with a high return on investment and do so with peace of mind. (We do NOT provide investment advice.) Contact Us if you would like to learn more about our services, especially TAP, our high-level Tactical Action Plan Solution, designed to help you strategically and tactically optimize your business. We would welcome the opportunity to speak with you.

info@gmsbusinessconsulting.com

707-218-3135